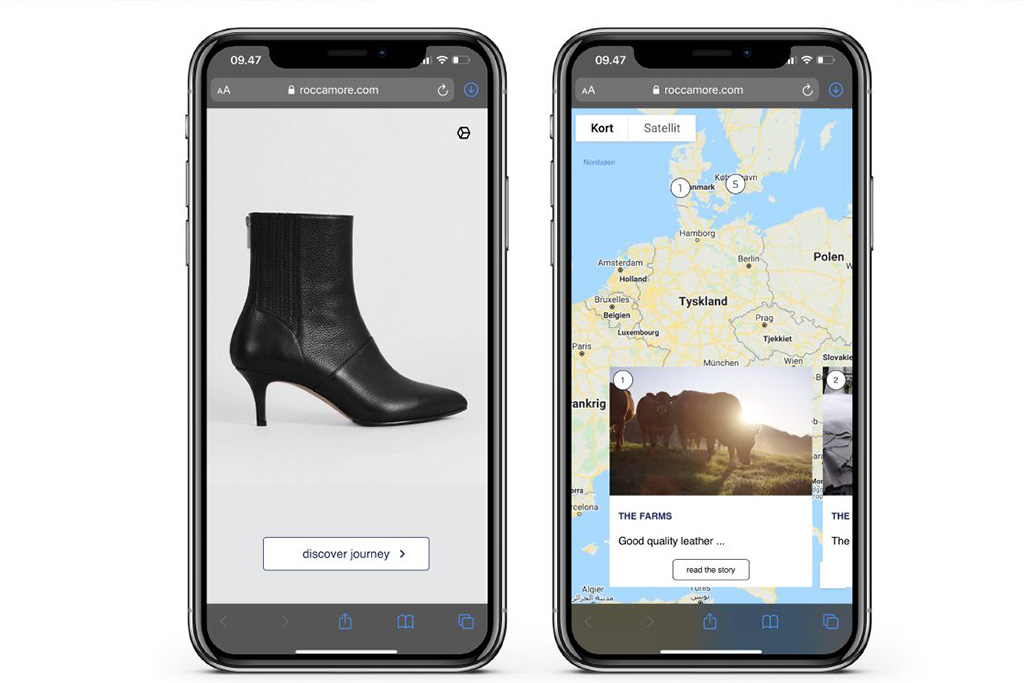

Shoe Brand Roccamore Uses Blockchain to Tell Stories

When customers purchase shoes from Danish company Roccamore, a story is included. And blockchain technology is helping make those stories authentic.

If Growth Is to Continue, Danish Fintech Needs More Talent

Thanks to several major startups driving growth, the Danish fintech scene is full of success stories and employment in the industry has more than tripled in five years. The problem? They’re running out of people, and if Danish fintechs are to keep up with the rest of the world, they need to attract more digital talent.

Bank vs. Fintech: The Fintech industry has matured and diversified

The relationship between established banks and fintech startups in Denmark hardly got off to a smooth start; it even involved a police report. In just a few years, however, the fintech industry has matured and have begun to collaborate with banks—a joint effort that may well be needed, if the financial industry is to weather the technological storms ahead.

The Business Bank of the Future Looks Very Different for SMEs

In the future, small to medium sized companies won’t just go to the bank for loans and advice. They’ll also expect the kind of fintech solutions that support their business, which several banks have already begun to offer.

Are E-Currencies A New Cold War?

China, the US, and Europe are all developing digital versions of their currencies. But it is a game of grand politics more than it is a quest for financial inclusion and better financial experiences, says expert.

Fintech At The Crossroads: Realizing The Full Potential

Financial technology or "Fintech" - using technology to deliver better financial services to the masses - has undergone explosive growth in recent years. The number of startups has grown from 71 to 280, and today they employ more than 2.300 people.

A Payment Is Just a Payment, the Trick Is to Turn It into a Service

There is no shortage of payment platforms that can move money from A to B. Fintech companies are therefore taking simple payments to the next level, by connecting other services to the payment that meet particular needs in the market or make the payment experience even better.

Blockchain without Anonymity: Decent Enough for Established Businesses?

Saxo Bank founder Lars Seier is determined to build bridges between blockchain and established businesses through the blockchain Concordium. For instance by removing the option of anonymity within the system.

The Cloud Is Creating New Opportunities for Fintech Start-ups and Established Banks Alike

Companies in the financial sector are beginning to recognise the opportunities and benefits that come with switching to cloud-based platforms. Developing in the cloud makes it much easier to scale, be compliant and run an agile business, which both fintech start-ups and established banks can benefit from.

Account-to-account Payments Are Gaining Ground. But the Credit Card Is Unlikely to Go Extinct

Both start-ups and payment giants have turned their attention to account-to-account payment methods, which are often cheaper and faster than traditional card-based payments. But that doesn’t necessarily mean that plastic cards don’t have a future.

Howart Compliance: Regulation and Compliance Is Not an Obstacle to Growth

All fintech companies have to deal with compliance. And according to the regtech and advisory firm Howart Compliance, there’s a distinction between complying with rules and regulation and implementation according to best practice.

Wind and Solar Energy for the Many!

As investors become increasingly interested in sustainability, a number of fintech companies have leapt to the challenge, and are helping investors channel their money into sustainable companies. This generates another challenge: How do we measure the sustainability of a company?

The Tracks Are Being Laid. Now Danish Fintechs Are Growing Across Europe

The PSD2 Directive has created a framework for financial services operating all across Europe. Danish fintechs are now using this to scale their business across borders – but cross-border growth is by no means easy.

Fintech Companies Are Uniquely Placed to Channel Investor Capital into Sustainability.

As investors become increasingly interested in sustainability, a number of fintech companies have leapt to the challenge, and are helping investors channel their money into sustainable companies. This generates another challenge: How do we measure the sustainability of a company?

Fintechs To Watch

Fintechs to watch!